A common sense approach to customer intelligence (CI)

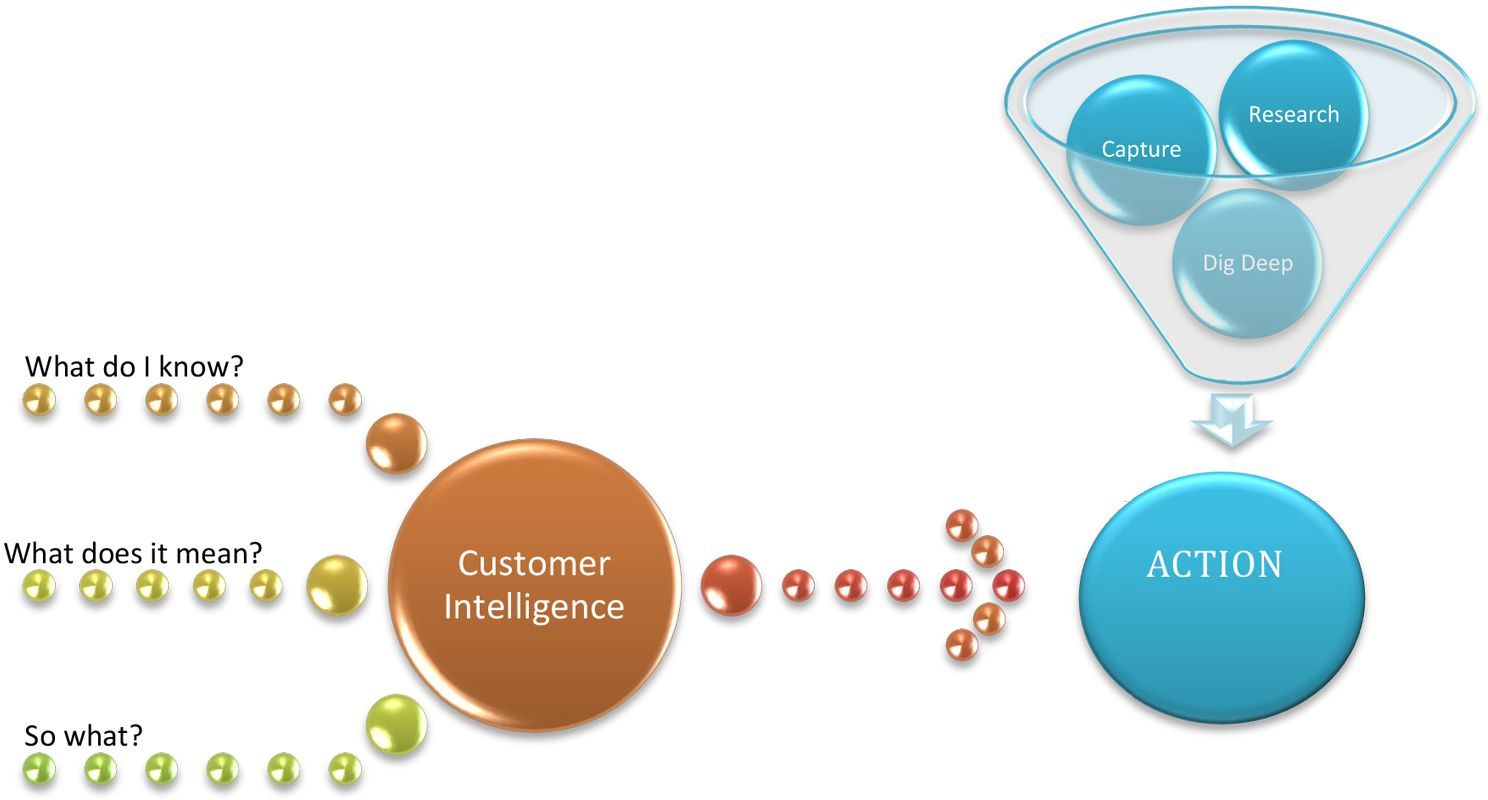

Figure 1: As simple as it gets!

Ok, starting out with my first blog ever, nervous? Yes! Excited? Most certainly. So here we go!

Insight and customer analytics as subject matters I’m hugely passionate about. With almost 10 years of experience in this discipline, I’m yet to see an organisation embrace the somewhat simplicity of this concept customer intelligence? This is by far not a new subject and I know much has been written and published on it. But I’m hoping I can share my experiences and you find my perspective a little more insightful, or should I say down to earth, to what you might already know.

My professional experience to date tells me most renowned or household named brands don’t seem to grasp this concept in all of its simplicity. They seem to expect that CI should be complicated and expensive! But is it really? Complicated maybe not, expensive? Maybe, depending on the approach deployed within the business. Some have been lucky, some just miss the mark completely (that’s the expensive bit), some just fall short and some get it right but fail in sustaining it and integrating it into the wider business strategy mainly due to business politics. Once worked for a global company that believed CI was all about bombarding customers with campaigns using all possible communication channels known to man provided you personalise those communication then you’re good to go. Another defined its customer intelligence by how many of its customers made frequent purchases and if they will buy again? Another interpreted this as producing KPI reports.

Now being realistic I think the misunderstanding here comes from the lack of understanding of the real meaning of the word “intelligence”. Wikipedia says this word has controversial meanings because intelligence can be defined in different ways. A dictionary defines it as “the ability to acquire and apply knowledge”. That said it would be fair to conclude therefore that intelligence = ability to learn.

Taking this basic definition a step further as surely this can’t be all what these global companies are spending a chunk of their marketing budgets on? Learning can’t be that difficult, complicated and expensive? The key question here should be how am I going to learn about the people who make my business what it is? Or who will make my business what I want it to be? Answer this question(s) and your strategic approach to customer intelligence will shift 360 degrees or maybe by just 45 degrees, either way it will shift. Too often I’ve seen businesses just spend without a clear direction….so single-view of your customers is critical but you haven’t resourced or train your data capturing department? Seriously you can have the most expensive and sophisticated customer databases, but if data capturing and quality is poor, it will not deliver….and simply creating a customer intelligence department will make no difference either.

Intelligence is beyond learning, gathering of information or churning of reports for the sake of it. I am not suggesting in any way that these are unimportant. No, they play a role in getting customer intelligence right and right first time round. The value-added of intelligence is therefore what you do with it! Intelligence is insight in action (see Figure 1).

Firstly: Customer intelligence should start with what you know and not what you don’t?

Senior management have often missed this point. They get into an auto-pilot mind-set and believe the way their customers behaved yesterday is how they will behave today and continue that pattern tomorrow, after all, it tells a better story that way. If this expected behaviour should change for whatever reason, the next thought line is “we must be missing something else out there, let’s do research to find out what it is”. Research has its place but not here. Read my post on “Listen to your customers” to get into this.

Secondly: Now that you know what you know, what does it mean?

This is where you start to generate insight…..nuggets of added value information. For example, so you know that 75% of your customers are female? 90% of these have young families? Our churn rate for these customers is highest during summer months when we raise the prices? New customers with this profile are recruited with summer sales communications at the start of autumn. Your insight or knowledge-nugget could be one of many…..such as, these type of customers like your products but are price sensitive. Brilliant, so now you know.

Thirdly: What are you going to do about this? Now and tomorrow?

Basically you want to address the so what? of this insight nugget. This is where you start to formulate your plan of action(s) which makes the core of your customer intelligence investments and strategies which includes:

- You can action NOW

- Research; you may want to support the justification of your proposed strategy

- Capturing; you may find out that you’re missing out on critical data that could help you justify or implement your strategy

- Dig deep; tidy up the data you already have. Data quality can never be over emphasised. Remember GIGO (garbage in, garbage out)

Customer intelligence is fluid, variable, not fixed simply because your customers are not static! Intelligence is as simple as actions from uncovered insight - think of this concept like this and see what happens! It doesn’t matter if you’re an established global business, an SME or a new start-up. The principles are the same. What do you think?

An interesting article here from Accenture on this subject. (PDF downloadable on the click on here. User must have Adobe installed).

Let’s get started

If you would like to find out more about how our data analytics solutions can help your business performance, or have any other general enquiries, please get in touch with us.